What is the 1 product in Shark Tank history

Top 10 best-selling 'Shark Tank' products

Dozens and dozens of founders have pitched their businesses and wares to the investors on ABC's "Shark Tank" over the last 11 seasons some have been clever and others memorable. And then there are the ones that are bringing in a ton of money. USA Today used sales figures provided by Sony Pictures, which produces the show, to rank the top 20 best-selling "Shark Tank" products ever, which had a total of $1.8 billion in retail sales.

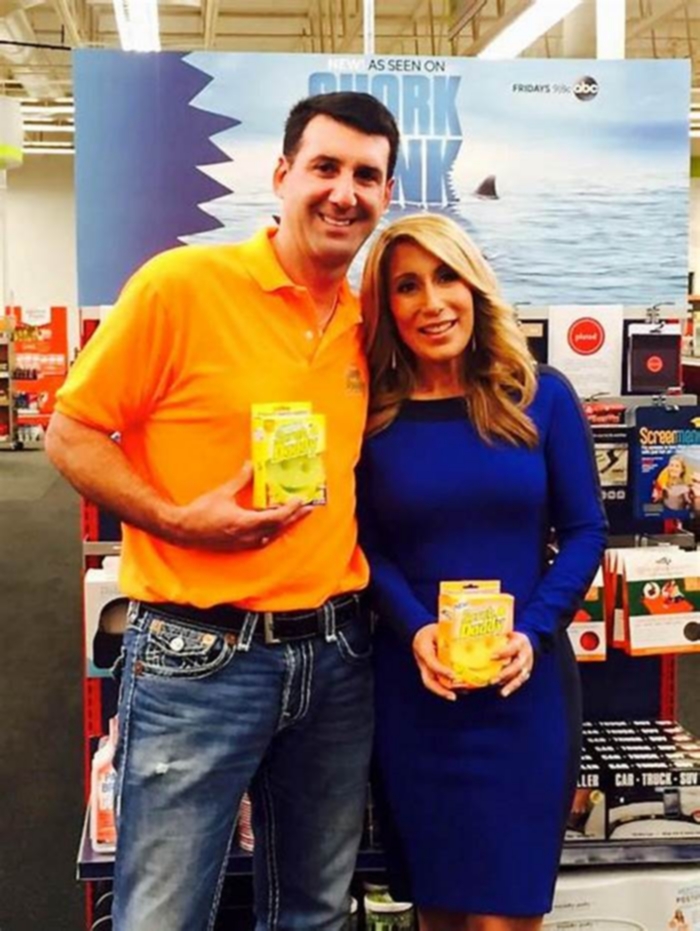

One Shark in particular has stake in 10 of the top 20 companies: Lori Greiner. With companies like Scrub Daddy, a kitchen-sponge line with $209 million in sales, and Squatty Potty, a footrest for the toilet with $164 million in sales, Greiner has many interesting and profitable "Shark Tank" companies in her portfolio.

Here are the 10 top-selling products from "Shark Tank", according to USA Today:

1. Bombas

Bombas on Shark Tank.

Source: Bombas | Facebook

In a season 6 episode that aired September of 2014, the co-founders of sock company Bombas got a $200,000 offer from Daymond John for a 17% stake in the business. (In many cases, deals change after the episode tapes and due diligence is done.)

Now, the company has $225 million in lifetime sales.

In 2011, a Facebook post that said socks were the most requested clothing item at homeless shelters inspired Bombas co-founders David Heath and Randy Goldberg to create the most comfortable sock possible and to donate a pair for every pair sold.

"How sad is it that something I've never spent more than a couple of seconds thinking about [how to pay for] could be seen as a true luxury for somebody else," Heath, co-founder and CEO of Bombas, told CNBC Make It in April.

According to John, Bombas is one of his top three most successful "Shark Tank" investments.

"It's been a dream working with them, honestly. They're laser-focused," John told CNBC Make It in April. "I don't even know if they ever call me for anything more than a little bit of words of advice, and they go out and they execute, so it's not been a lot of heavy lifting on my part. They've also taught me about the value of when a consumer feels that you have a social cause that is really amazing and they believe in you, how they will support you."

2. Scrub Daddy

Craig Sjodin/ Disney ABC Television Group/ Getty Images

Since its launch, sponge company Scrub Daddy has done $209 million in sales.

But back in 2012, Scrub Daddy founder Aaron Krause was well prepared for his season 4 "Shark Tank" pitch, he told CNBC Make It.

"What I learned is if you're unprepared, you're the bait," Krause told Make It at CNBC's iConic conference in 2017. "And the Sharks will eat you alive."

On Krause's episode, which aired that October, Greiner offered Scrub Daddy $200,000 for a 25% stake in the company.

Grenier said in 2014 Scrub Daddywas one of the "best investments" she's ever made on the show.

3. Squatty Potty

Bobby Edwards demonstrates how the Squatty Potty works.

Jeniece Pettitt | CNBC

Squatty Potty, a bathroom footstool that helps create "healthy toilet posture" to prevent and help with constipation, has generated $164 million in sales since 2011.

"Everyone is like, 'Why didn't I think of that?'" Bobby Edwards, the creator and CEO of Squatty Potty, told CNBC Make It in 2018. "I have proven a lot of people wrong, and it's felt really good."

Edwards came up with the idea of Squatty Potty in an effort to help his mother's constipation troubles.

"There was nothing out there on the market that we could find to help us solve the problem," he told Make It. "So we made it."

When he took his invention to "Shark Tank" on season 6, Greiner offered Squatty Potty $350,000 for a 10% stake in the business. The episode aired in November of 2014.

4. Simply Fit Board

Simply Fit Board, a balance-board workout tool, is another successful investment by Greiner, with $160 million in lifetime sales.

In a season 7 episode that aired in November 2015, Greiner offered its mother-daughter co-founders, Gloria Hoffman and Linda Clark, $125,000 for a 20% stake in Simply Fit Board.

Just 24 hours after the episode aired, Simply Fit raked up $1.25 million in sales, according to Hoffman.

"When you're a mom that wants to show your kids that anything is possible and overnight, my whole life changed," Hoffman said during a December 2016 "Shark Tank" update.

In 2016, Greiner revealed that Simply Fit Board partnered with Walmart, putting the product in each store across the country.

"To see the effect on Gloria, to see how much it has changed her life, that's why I do what I do," Greiner said in the update episode. "That's why I'm a Shark."

5. The Original Comfy

The Original Comfy, a company that sells a line of blanket-sweatshirt hybrids, has done $150 million in sales since its launch.

The founders' "Shark Tank" pitch, which aired in December 2017 on season 9, was Barbara Corcoran's "favorite pitch," according to USA Today.

"All they had was a sweatshirt-blanket contraption with a hood; I thought they were crazy," Corcoran said.

Ultimately, Corcoran believed the product could go viral and offered $50,000 for a 30% stake in the company.

6. Tipsy Elves

Tipsy Elves co-founders Evan Mendelsohn and Nick Morton met in college and are still great friends.

Jeniece Pettitt | CNBC

Tipsy Elves, a company that sells ugly Christmas sweaters, has done $125 million in sales since 2011.

Robert Herjavec told CNBC Make It in April 2019 that Tipsy Elves was his most successful "Shark Tank" investment.

"I didn't bet on the product, I bet on the guys," Herjavec told Make It. "They left these secure, cushy jobs to sell inappropriate, ugly Christmas sweaters online. Anyone nuts enough to do that must really believe in the idea."

Herjavec offered the founders $100,000 for a 10% stake in the company on the season 5 episode that aired in December 2013.

7. The Bouqs

The Florist Collection from the Bouqs Company.

Source: The Bouqs Company

The Bouqs, an online flower bouquet seller, did not receive any offers during the founders' season 5 pitch, which aired in May 2014 but Herjavec later invested in the company.

Three years after the show, "Robert Herjavec reached out to me to ask if we could do the flowers for his upcoming wedding," The Bouqs co-founder John Tabis told CNBC in March.

"[Tabis] said, 'Come and see me. I'll explain the flower business to you.' [He] draws it out for me, shows me what they're doing. I'm like, 'I love it,'" Herjavec said in a blog post for The Bouqs in February 2017. "So I took part of their last round. We just raised $24 million."

Bouqs has done $100 million in sales since its launch.

8. Sleep Styler

Sleep Styler, a company that sells heat-free hair rollers, appeared on season 8 of "Shark Tank" and caught Greiner's attention.

"I knew I would really be able to help [founder] Tara [Brown] get this product out on the market in a fast and all-encompassing way where the Sleep Styler would become a household name within a year," Greiner told Success magazine in August 2017. "Within five minutes of watching Tara pitch, I had already visualized a great plan in mind."

Grenier offered Brown $75,000 in exchange for a 25% stake in the company on the episode, in an episode that aired in March 2017.

Sleep Styler has done $100 million in lifetime sales.

9. Lovepop

When Wombi Rose and John Wise, the co-founders of Lovepop, a pop-up greeting card supplier, appeared on season 7 of "Shark Tank" in December 2015, Kevin O'Leary offered them $300,000 in exchange for a 15% stake in the business.

Lovepop has now brought in $80 million since its launch.

Prior to creating Lovepop, Rose and Wise were naval architecture students with a love for ship design.

"It's so cool, and it's also exactly the same way you design a ship," Rose told CNBC. "You take a 3-D shape; you splice it into planes. The way that those planes intersect, you draw lines and then you cut out the pieces and assemble them by hand. And this is that same concept but miniature."

10. Cousins Maine Lobster

Jim Tselikis and Sabin Lomac of Cousins Maine Lobster

Source: Cousins Maine Lobster

Cousins Maine Lobster, a seafood truck business, appeared on season 4 of "Shark Tank" in an episode that aired in October 2012.

Co-founders Sabin Lomac and Jim Tselikis say the show changed everything for their business.

"Barbara's influence on the company was felt from day one," Tselikis wrote in a piece for CNBC Make It in June 2016, referring to Barbara Corcoran, who offered them $55,000 in exchange for a 15% stake in the company. "We were able to grow our fleet (one truck became two, which soon became four), and the roving lobster shacks were canvassing Southern California in a few months."

The business has generated $65 million in lifetime sales.

USA Today has the full list of the top 20 "Shark Tank" companies.

All sales figures are cumulative as of Sept. 10, 2019, according to USA Today.

Disclosure: CNBC owns the exclusive off-network cable rights to "Shark Tank."

Like this story? Subscribe to CNBC Make It on YouTube!

See also:

Shark Tank deep dive: A data analysis of all 10 seasons

Shark Tank the reality show where entrepreneurs pitch ideas to a panel of celebrity investors just wrapped up its 10th season.

Thats 222 episodes, 895 pitches, 499 deals, $143.8m worth of invested capital, and nearly $1B in company valuations.

Looking back at all of this got us curious: How much is the average Shark Tank deal? Are certain entrepreneurs more likely to make deals than others? What types of products are the most successful historically? Which sharks throw down the largest sums of money, and what do they invest in?

Lucky for us, an angel investor (and super-fan) by the name of Halle Tecco has spent hundreds of hours collecting extremely detailed data on every episode since 2009 and she graciously agreed to share her work with The Hustle.

A small selection of findings:

- 56% of contestants successfully make a deal

- Women are underrepresented on the show and secure smaller deals

- The average deal amount is $286k; the average equity given up is 27%

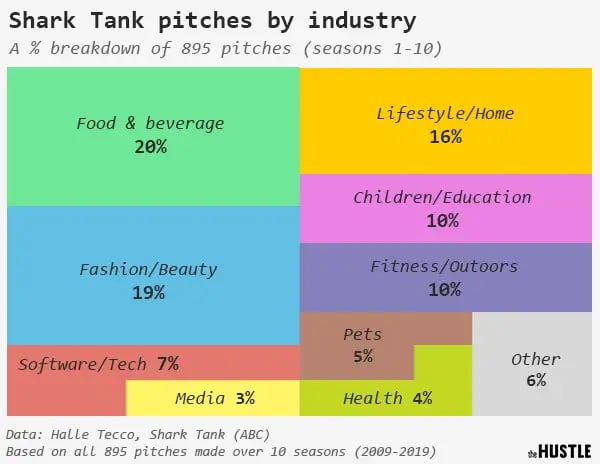

- Food (20%) and fashion (19%) are the most popular pitch industries

- Mark Cuban is the most prolific deal-maker (151 deals in 10 seasons)

Lets dive in deeper.

Who are the contestants?

The data we used for this analysis includes: All 895 pitches aired on the show (2009-2019); whether or not each made a deal; industry category; gender of the entreprenuer(s); how much they asked for ($ amount, % equity, valuation); deal specifics ($ amount, % equity, valuation); and which sharks invested.

A big part of any show is who it chooses to include. So, we began by breaking down the demographics of Shark Tank contestants.

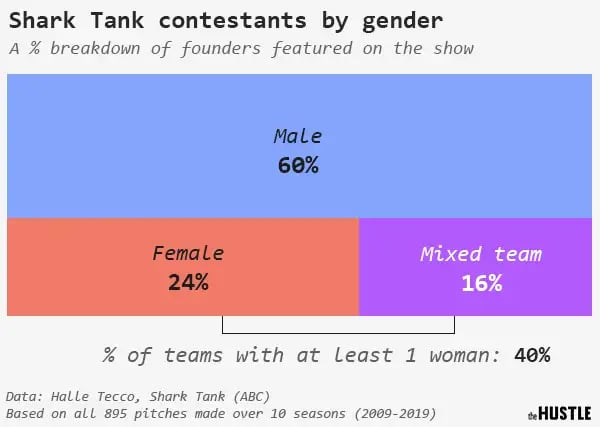

Six out of 10 Shark Tank contestants were men, or all-male teams, while less than one-quarter were women. Per the US Department of Labor, women own 36% of all American businesses, meaning that female entrepreneurs are under-represented even in the manicured landscape of reality television.

Well come back to this disparity in a bit but first, lets take a big-picture look at what types of businesses these 895 contestants pitched on the show.

More than half of all pitches fell into 3 categories: Food & beverage (20%), Fashion/Beauty (19%), and Lifestyle/Home (16%). Booze and cupcakes seem to tickle the Shark Tank producers fancy.

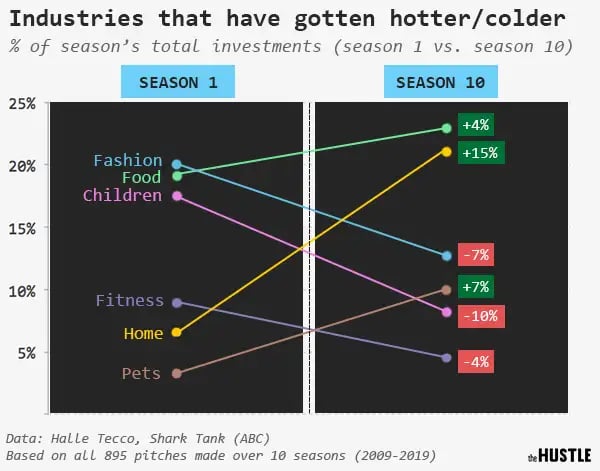

Over time, the popularity of certain industries has changed.

Between season 1 and season 10, food and beverage pitches increased by 15 percentage points. In that same period, ideas for childrens products tanked by 10 percentage points.

Now that we have a basic sense of who the contestants are and what theyre pitching, lets turn to the interesting question: How do these factors affect who gets money?

Who is making deals?

In Shark Tank history, 895 teams have made pitches. Of these pitches, 56% (499 of 895) succeeded in landing a deal.

When we look at the gender breakdown of successful contestants, 57% (284) were men, 27% (133) were women, and 16% (82) were mixed-gender teams a fairly representative distribution of who makes it on the show to begin with. (Compartitavely, only 2.2% of all VC dollars go to women in the real world.)

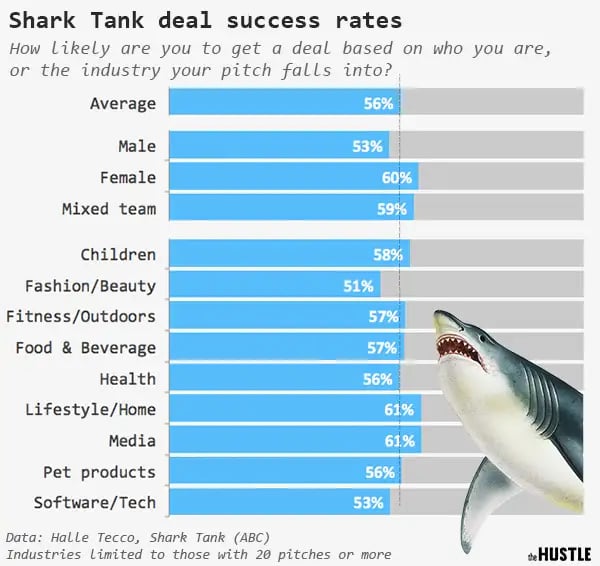

But how likely are you to get deal based on who you are and what youre pitching? The numbers tell a different story when we look at success rates within categories.

Though under-represented on Shark Tank, 60% of women who made it onto the show (133 of 221) got a deal, compared to 53% of men (284 of 535).

Along industry lines, contestants pitching lifestyle/home products seemed to fare the best (61% success rate) though all major categories had at least a 1-in-2 chance of walking away happy.

Certain niche categories (with smaller sample sizes) had a bit more variance: 75% (9 of 12) of contestants hawking automotive products got a deal, compared to only 35% (6 of 17) in the business services space.

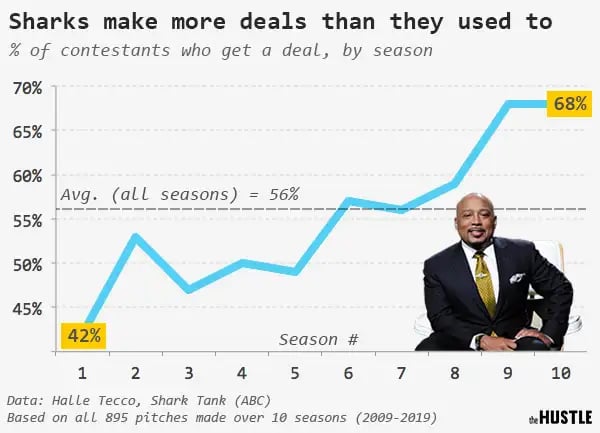

The average deal success rate (56%) has also seen some variance over the seasons.

Ten years ago, only 42% of hopefuls got a deal; this past season, that figure was up to a whopping 68%.

Now more established, the show could be attracting higher-quality, more investment-worthy pitches. But its also likely that the shows producers simply wanted more of the action and positive outcomes that make for good TV.

As it turns out, good TV doesnt just call for more deals; it calls for better and bigger deals. But certain contestants on the show seem to consistently fare better than others.

What does the average Shark Tank deal look like?

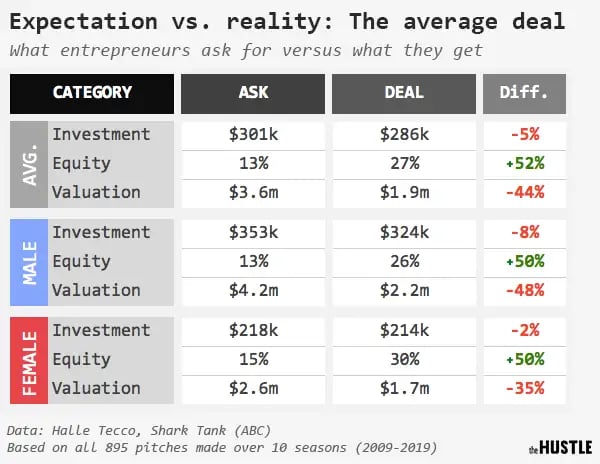

Entrepreneurs come onto Shark Tank with lofty expectations.

The average contestant asks for $301k, is only willing to sacrifice 13% of his/her company, and seeks a $3.6m valuation. But like most things in life, expectations often fall a bit short of reality.

That reality: Though the average dollar amount of a deal ($286k) comes quite close to the ask, contestants sacrifice more than double the stake in their companies for it and walk away with their projected valuation nearly cut in half.

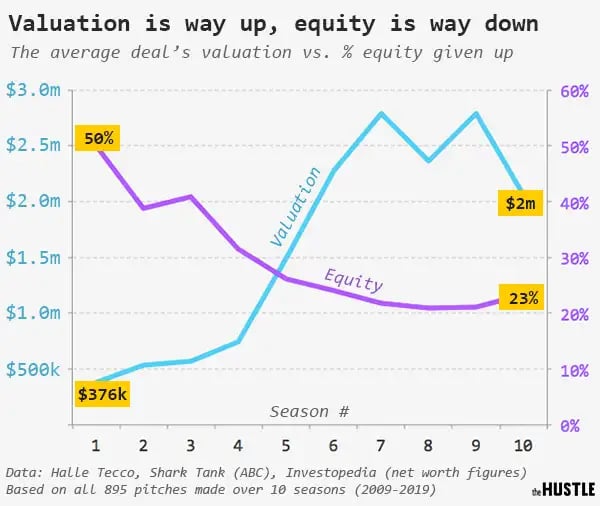

Its worth noting that these trends have changed in recent seasons.

When the show first began, the average contestant had to give up half of his/her company in exchange for much smaller valuation. Over time, the equity stake sharks take from contestants has greatly diminished (and valuation has gone up commensurately).

But not all contestants have reaped the benefits of these positive shifts.

Female contestants ask for, and receive, much smaller deals than male contestants ($214k vs. $324k). They also sacrifice more equity (30% vs. 26%) and walk away with 23% smaller valuations.

Some might attribute this to the oft-peddled (and largely debunked) confidence gap between male and female businesspeople. But the data reveals a more likely cause: In the earlier seasons, the gulf between deals made by men and women was small; around season 6, it dramatically widened.

This spike was caused by a rash of massive deals cracked in the middle seasons, when the shows ratings peaked.

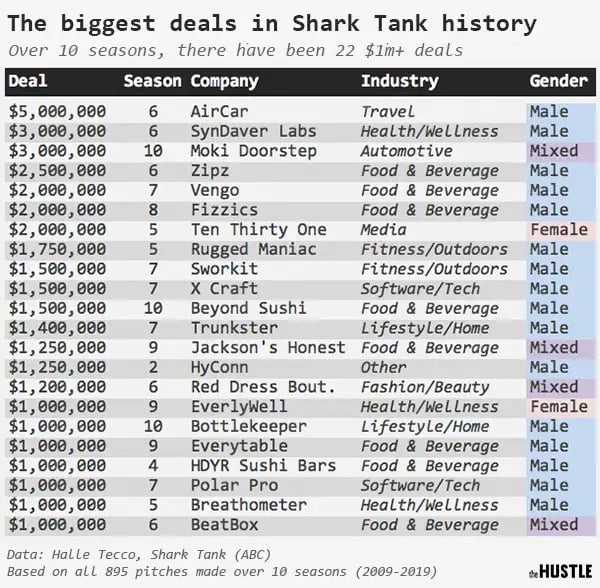

A look at the highest and lowest valuations in Shark Tank history shows that from this point onward, deals began to skyrocket in size and the overwhelming majority (80%) of the shows biggest deals went to male entrepreneurs.

Of the 22 $1m+ deals, only two less than 10% went to female, or all-female teams. More than 7 in 10 (and 80% of the top 10) went to men.

To truly understand these figures, and why theyre skewed this way, we have to turn to the people making the deals: the sharks.

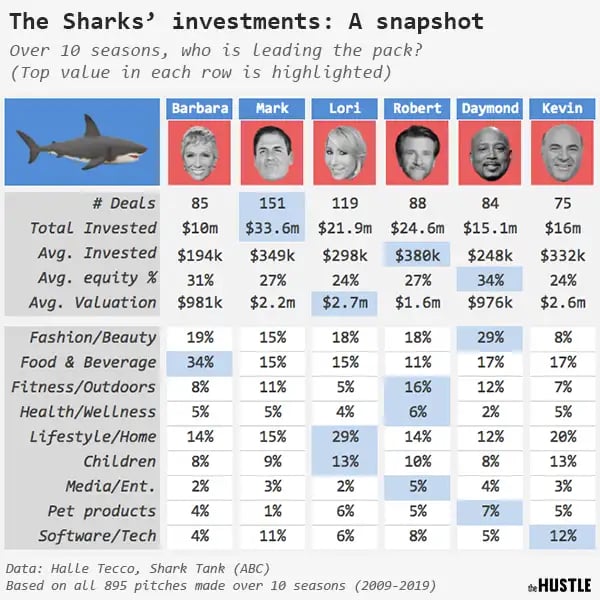

Which sharks invest the most money?

Though Shark Tank has seen a rotating cast of guest investors (ranging from baseball superstar Alex Rodriguez to actor Ashton Kutcher), the panel has largely been made up of 6 people:

Lets look at their investment history.

Mark Cuban tops out on deals made (151) and total dollar amount invested ($33.6m). This is impressive considering that he didnt join as a full-time cast member until season 3, but is also expected since hes the wealthiest of the lot by a country mile (he sold Broadcast.com to Yahoo for $5.7B in 1999).

Lori Greiner, who ranks second in deals made (119), was also a late addition to the show. But since joining the cast in season 4, shes made up for lost time: Combined, she and Mark account for 54% of all Shark Tank deals.

Favored industries closely align with the investors backgrounds: Daymond John (FUBU) has a vested interest in fashion, Lori Greiner (the Queen of QVC) sticks to quick-selling home goods, and Kevin OLeary (an ex-software guy) invests in heres a shocker! software.

For fun, we wanted to see how the sharks total Shark Tank investments stacked up to their purported net worth (gleaned from Investopedia).

Here, we see a dramatically different picture: While Cubans pack-leading $33.6m ranks last against his whale-sized net worth, Greiners investments represent nearly a quarter of her reported $100m fortune.

Of course, there are issues with this (these net worths are current, while the investments were made over 10 years) but its still an interesting way to contextualize the money sharks drop in the context of the show.

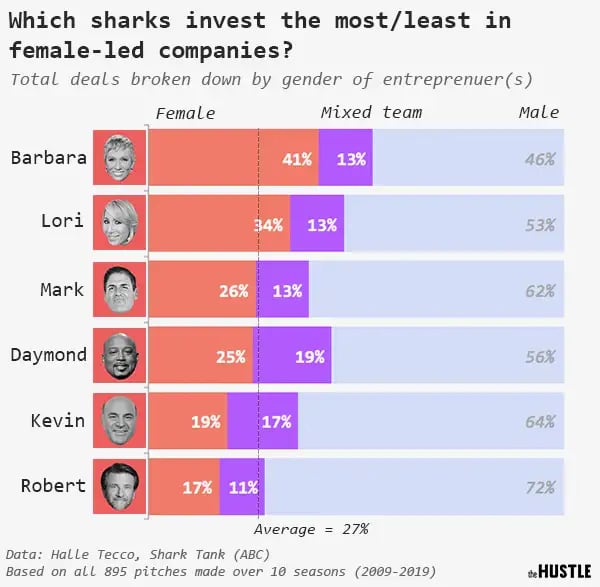

Lastly, given the shows gender disparity, we wanted to check the sharks track record of investing in female-led companies.

Shark Tanks two female hosts, Corcoran and Greiner, have the most balanced investment records.

The men, on the other hand, all fall below the average. Some sport embarrassingly low tallies: Famous for being The Shark With The Sharpest Teeth, OLeary doesnt seem to have much of an appetite for female-led companies, which only make up 19% of his deals; at 17%, Herjavec fares even worse. It has been said that Shark Tank is an egalitarian realm, where entrepreneurs succeed only on their merit. But as the data shows, television is not immune from the structural imbalances of reality.